Invest In Your Future

You spend a countless amount of time and effort working to provide for your family. People have many different “wants” and “needs”. Yours may include making sure that you have enough money to keep your family safe and comfortable. You may want to have the money to allow your children to participate in extracurricular activities and go to post secondary schools, without the burden of debt. You may also want to be able to escape your everyday lives and take a vacation, to enjoy life. Most importantly, you should want to make sure that you have a plan for retirement where you can live comfortably, without the worry of running out of money.

Now is the time to make sure that all of your hard work is being used in the best way possible for you and your family. You can do this by making sure you are increasing your net worth, reducing your taxes and protecting your family’s future. Give us a call at Carson Financial to start creating the path towards retirement.

Welcome to

Customized Financial Advice & Investing

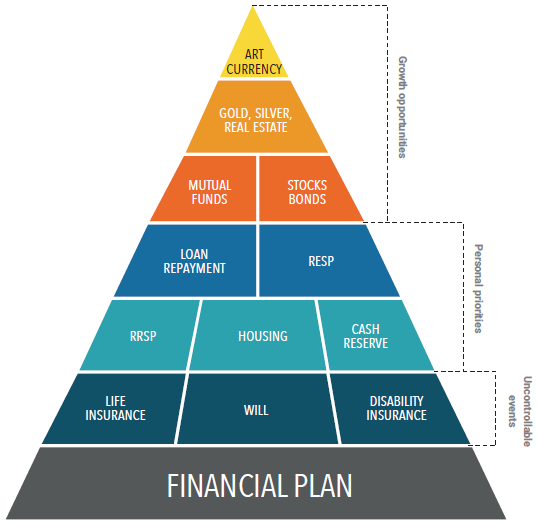

At Carson Financial we work with you starting at the bottom of the financial pyramid and working our way up. We want to make sure that you have a solid financial foundation that protects your financial future. Once the base is secure we will move up the pyramid to start growing your wealth. We will be protecting and growing your wealth based on your goals and needs. Everyone is different so no plan is the same. The steps are always similar but the amounts, types of protection or investments chosen are based on your individual scenario.

It doesn’t take much to get started. For some, it’s as little as $25 towards a TFSA. For others, it’s $15 a month for life insurance. We help you find the right products at the right price.

Our goal is that you can sleep easy knowing your financial future is safe.

Plan

Financial Planning

This is the first step for everyone. If we don’t know where we are going, we don’t know how to get there. We help you customize a plan. Following this plan will ensure that you arrive at your desired location at the right time.

There are two steps to this plan. Protecting what you currently have and growing your wealth to where it needs to be.

PROTECT

Protect you and your financial future with the proper insurance

The foundation of a good financial plan is to protect your financial future. We do this by protecting your source of income, which is also your most important asset. That asset happens to be YOU. We help make sure that whether you get critically ill, become disabled and can no longer work or pass away prematurely, you and your family will continue to have a source of income.

We also protect your investments while they grow.

Divesrify

Create a Diverse Portfolio

Diversification is important for any financial plan. Not only diversity in your investments, but diversity in the products you are using for that financial plan. We need to make sure that you and your family are protected before we can start growing your net worth. We don’t want it all crashing down because of an unexpected circumstance that we could have planned for.

Manage

Personal Wealth Management

At Carson Financial, we help manage your wealth by planning appropriately and diversifying your portfolio. We minimize your taxes, protect what you have, and grow what we can to make sure that your finances are secure no matter what comes along.

One Size Fits One

Create a Strategy That Works For YOU

There is no one-size-fits-all in financial planning. There are certain things that all financial plans should have. How those are set up is unique to every individual and family. At Carson Financial, we help make sure that your plan is unique to you and your situation.

How We Work. Our Mission & Values

At Carson Financial our ultimate goal is to make sure that you can sleep at night, knowing your financial future is safe.

We do this by staying independent. We work for you. We are licensed with many different companies. The benefit to you is that we are able to find and present ways to grow and protect your assets from multiple sources. In this way, we are making sure you are getting the best return for your dollar. We also help create strategies to pass your wealth onto the next generation as efficiently as possible.

Financial Services

At Carson Financial we offer multiple products to help with your financial plan.

Some protection products include

- Life Insurance

- Disability Insurance

- Critical illness Insurance

- Mortgage Insurance

- Personal health benefits

- Many other Insurance products

We also offer investment products to grow your wealth from many different companies. Some of these include

- TFSA

- RRSP

- Non Registered

- RRIF

- LIF

- and more

Financial Plan

At Carson Financial we help create a plan with you that will work for you in every stage of your life. That way, you can rest easy knowing that you are going to be ok no matter what happens.

Retirement Plans

Retirement is different for everyone. Schedule an appointment with us at Carson Financial to find out what you need to do to reach your goals and retire comfortably.

Estate Planning

There are always two beneficiaries when you pass away. The first beneficiaries are those that you want to receive the money. The second beneficiary is the government. We help maximize what will go to those that you wish to receive your assets and minimize what the government receives.

Financial Protection

Proper Financial Protection means protecting your cash flow. You need cash flow to pay for everything in your life- from the food on your table to the roof over your head, and making sure to save for retirement. Everything is possible because of your cash flow. This makes YOU your most valuable asset, as your cash flow is usually directly dependant on your work. We want to make sure that your cash flow is protected by making sure that you have the proper insurance in place for the right price.

Risk Management

It is just as important to protect what you have as it is to grow it. At Carson Financial we help by putting in the protection to reduce your risk of losing everything. Once that is in place, we maximize your net worth. This is how you manage your financial risk.

Portfolio Management

At Carson Financial we help create a portfolio for you that is well-diversified, rebalances at opportune times, is tax-efficient, and manages risk.

Let Us Help You Take Your Money To New Heights

We have a three-step approach to making your money work harder for you.

The first is to put the proper protection in place. This is important because we cannot put the proper protection in place unless you are healthy enough. So this can potentially be limited in the future.

The second step is to grow. We want to grow your net worth by working with you to create an investment strategy that will work for you. During this step, we want to make sure that we reduce your expenses, fees, and taxes, and increase your potential earnings. The fastest way to get your net worth up is to increase your cash flow.

The third step is to enjoy. Once we have protected and grown your finances, it is time to enjoy. Everyone is different, so maybe your enjoyment is heading to the cabin and enjoying lake time. Maybe it is enjoying things in your home. It could be traveling to places you haven’t been or you might have your favorite traveling spot. These are only a few of the ways people enjoy their life. Our goal is to help you spend more time doing the things you enjoy instead of worrying about your financial future.

Blog

Financial Resources and News

Blog and Financial Resources coming soon.

Contact

Get In Touch

Send us an email with your questions or concerns and we will get back to you with how we can help.

Financial Advisors.

At Carson Financial we offer many different products that help create an overall financial plan. We can help with one individual product or help with the whole plan. Schedule a virtual appointment today or give us a call to get started.